Paystone Review

- 22nd Aug, 2024

- | By Linda Mae

- | Reviews

Paystone, a fintech company based in North America, has rapidly become a top player in the payments and customer engagement sector. Established in London, Ontario in 2009, the company started its venture known as Zomaron. Throughout time, it has undergone substantial changes, changing its name to Paystone in 2019 after acquiring DataCandy, a Montreal-based software company that focuses on gift card and loyalty solutions. This rebranding was a crucial moment for the company, enabling it to broaden its offerings and increase its market share throughout North America. Lets read more about Paystone Review.

It offers a comprehensive suite of products designed to help businesses enhance customer engagement and streamline payment processes. Their offerings include automated payment processing, customer loyalty programs, gift card solutions, and reputation marketing tools. These solutions are combined in one platform, allowing businesses to control customer interactions, cultivate better relationships, and ultimately stimulate growth. The company’s platform is used by a variety of industries such as hospitality, retail, healthcare, automotive, and non-profits, and it caters to more than 25,000 merchant locations in Canada and the United States.

Paystone’s mission is focused on enabling businesses to establish impactful connections with their customers, turning regular transactions into chances for expansion. The company’s leadership, led by CEO Tarique Al-Ansari and CFO Abdullah Saab, is dedicated to innovation and growth, demonstrated through strategic acquisitions and continual improvements to their product lineup. Paystone aims to keep revolutionizing the payments and customer engagement sectors with innovative solutions that cater to the changing needs of businesses in an ever-growing digital environment.

Product and Service Offerings | Paystone Review

Paystone offers a robust suite of products and services designed to enhance both payment processing and customer engagement for businesses of all sizes. Their integrated platform is tailored to meet the diverse needs of merchants, making it a one-stop solution for payment processing, customer loyalty, and point-of-sale (POS) systems.

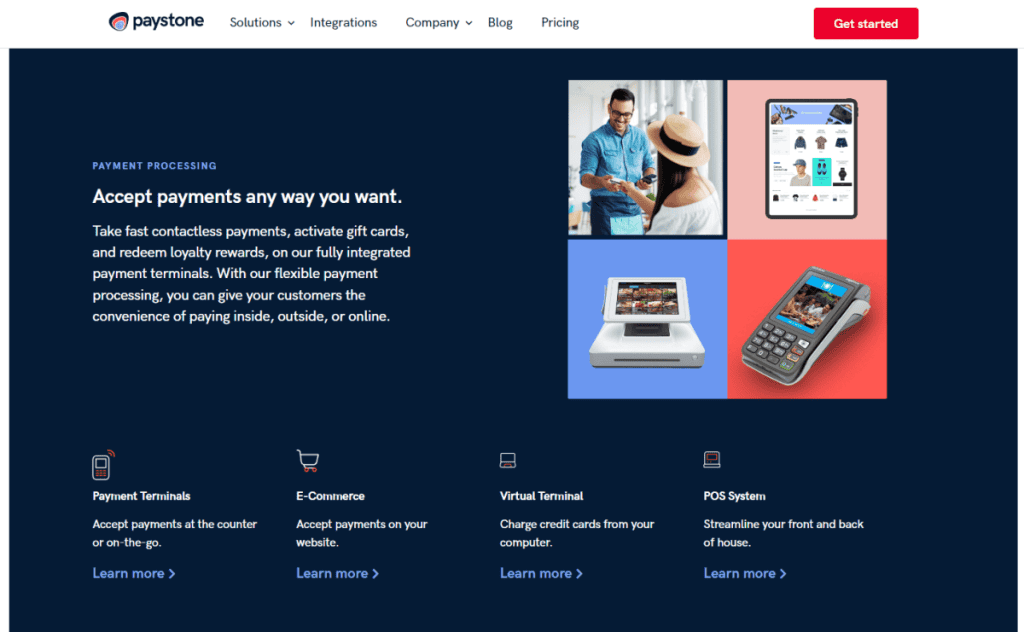

Payment Processing Solutions: Paystone’s payment processing services are designed with flexibility and security in mind. The platform supports a wide range of payment methods, including credit cards, debit cards, mobile payments, and contactless transactions. This flexibility ensures that businesses can accommodate various customer preferences, whether in-store or online. The payment processing system is built with advanced security features, including PCI compliance and encryption, to protect sensitive transaction data.

Another important aspect of Paystone’s payment solutions is their ability to be integrated with current systems. The platform smoothly combines with POS systems, e-commerce platforms, and other business software, enabling a cohesive approach to payment management. This merging simplifies procedures, minimizes manual input, and improves the overall effectiveness of business operations.

Customer Engagement Tools: Paystone goes beyond payment processing by offering a comprehensive set of customer engagement tools. Their loyalty programs and gift card solutions are designed to increase customer retention and boost sales. The marketing automation platform further enhances these efforts by enabling businesses to create personalized marketing campaigns based on customer behavior and preferences. These tools help businesses turn everyday transactions into meaningful customer interactions, fostering long-term loyalty and repeat business.

Point-of-Sale Systems: Paystone’s POS systems are designed for compatibility and ease of use. Whether through hardware or software, the systems integrate seamlessly with Paystone’s payment processing and customer engagement tools, providing businesses with a cohesive and efficient setup. Unique features such as real-time analytics, inventory management, and customer data tracking make Paystone’s POS solutions a valuable asset for any business looking to optimize their operations and enhance the customer experience. The systems are user-friendly, ensuring that staff can easily manage transactions, track sales, and engage with customers effectively.

Technology and Innovation

Paystone leverages advanced technology and innovation to provide a secure, scalable, and flexible payment solution for businesses of all sizes. By focusing on security features and adaptability, Paystone ensures that its platform meets the diverse needs of merchants while maintaining the highest standards of data protection.

Security Features

Security is a top priority for Paystone, and the company has implemented several measures to protect both merchants and customers. Paystone’s platform is PCI DSS (Payment Card Industry Data Security Standard) compliant, ensuring that all payment transactions are processed in a secure environment. This compliance involves stringent encryption protocols that safeguard sensitive payment information, preventing unauthorized access.

It not only meets PCI compliance requirements but also includes strong measures for detecting and preventing fraud. These characteristics consist of monitoring transactions in real-time to identify and stop suspicious actions before they cause financial losses. The platform utilizes advanced data protection methods to securely store customer data in accordance with regulatory mandates. The collaboration of these efforts makes Paystone a dependable option for businesses prioritizing transaction security.

Scalability and Flexibility

Paystone’s platform is designed to be highly adaptable, catering to the needs of small businesses as well as large enterprises. The scalability of the platform allows it to grow alongside a business, making it a viable solution for companies with multiple locations or those planning to expand. The platform offers multi-location support, enabling businesses to manage their operations across different sites from a single interface. This capability is particularly beneficial for franchises and enterprises with complex organizational structures.

Customization is another key aspect of Paystone’s offering. Merchants can tailor the platform to meet their specific needs, from customizing payment processing options to integrating with existing business software. This flexibility ensures that Paystone can adapt to various business models and operational requirements, making it an ideal choice for a wide range of industries.

User Experience

It is designed with the user experience in mind, offering an intuitive and efficient platform for merchants to manage their payment processing and customer engagement tools. The platform’s ease of use and robust customer support make it accessible and helpful for businesses of all sizes.

Ease of Use: One of the key strengths of Paystone is its straightforward onboarding process for new merchants. The setup is designed to be seamless, allowing businesses to get up and running with minimal hassle. The user interface is clean and intuitive, making it easy for merchants to navigate the platform and access the tools they need. Whether managing payments, setting up loyalty programs, or analyzing customer data, the platform’s interface is designed to minimize the learning curve, ensuring that users can quickly become proficient in its use.

The merchant portal is a standout feature of Paystone’s user experience. It offers detailed reporting tools that let businesses track their progress instantly. Merchants can quickly create reports about sales, customer interactions, and past transactions, helping them make smart business choices. The portal is designed to be straightforward and useful, making sure users can easily access and use the tools they need without any extra difficulty.

Customer Support: Paystone also excels in providing reliable customer support to its users. Support is available through multiple channels, including phone, email, and chat, ensuring that help is accessible when needed. The quality of support is consistently praised by users, who appreciate the knowledgeable and responsive assistance provided by Paystone’s support team.

In addition to direct support, it offers a range of resources to help merchants maximize their use of the platform. These include a comprehensive knowledge base, tutorials, and FAQs that cover common questions and provide step-by-step guidance. Feedback from existing users indicates a high level of satisfaction with the support services, highlighting Paystone’s commitment to ensuring a positive user experience.

Pricing and Contract Terms

It offers a pricing structure designed to be competitive within the payment processing industry, though specific details may vary based on the services required and the size of the business. The company aims to provide a transparent pricing model, though like many in the industry, the exact fees are often customized according to the merchant’s needs. This approach allows Paystone to cater to a wide range of businesses, from small startups to large enterprises, by adjusting pricing to align with the scale and requirements of the merchant.

Pricing Structure: Paystone’s pricing is generally built around a combination of flat fees, transaction fees, and service charges. While the exact rates are not publicly disclosed in detail, they are competitive with industry standards. Businesses can expect to encounter fees associated with payment processing, including per-transaction charges, monthly service fees, and potentially additional costs for value-added services like customer engagement tools or loyalty programs.

A main part of Paystone’s pricing is that it focuses on showing the costs clearly. Unlike some payment processors that have hidden fees, Paystone aims to give clear details about what businesses will pay. This clear information is important for companies to manage their costs well and avoid any surprise charges. But, like with any service provider, it’s important for businesses to check their agreement carefully to understand all possible fees.

Contract Terms: Paystone’s contract terms are designed to be flexible, accommodating the needs of various business sizes and types. The length of contract commitments can vary, with options that range from month-to-month agreements to longer-term contracts. This flexibility allows businesses to choose a contract length that aligns with their needs and growth plans.

Termination fees and conditions are also an important consideration. Paystone typically includes termination fees in its contracts, which can apply if a merchant decides to exit the agreement early. These fees are standard in the industry but should be clearly understood before signing. The renewal and negotiation terms for contracts are also straightforward, often allowing businesses to renegotiate terms as their needs evolve, providing a degree of flexibility in how the relationship with Paystone is managed over time.

Competitor Analysis: In the competitive landscape of payment processing and customer engagement solutions, it stands out with a unique combination of offerings tailored to the needs of small and medium-sized businesses (SMBs). To understand how Paystone measures up against its major competitors, it’s important to consider both its strengths and areas where it might lag behind.

Comparison with Major Competitors

It competes directly with other well-known payment processors and customer engagement platforms such as Square, Stripe, and Clover. While these competitors offer robust payment processing solutions, Paystone differentiates itself by providing an integrated suite that combines payment processing with customer loyalty programs and marketing automation. This all-in-one approach is particularly appealing to businesses that want to manage multiple aspects of their customer interactions from a single platform.

In regard to pricing, it is competitive, although Square and Stripe are frequently praised for their clear, fixed-rate pricing structures, which may be easier for certain businesses to grasp. Nevertheless, Paystone’s capacity to customize its pricing and provide personalized solutions could be a compelling advantage for companies seeking greater adaptability.

Strengths and Weaknesses Relative to Competitors: One of Paystone’s key strengths lies in its focus on customer engagement tools. Unlike many of its competitors that primarily focus on payment processing, Paystone offers robust loyalty programs and marketing automation features that help businesses retain customers and increase sales. This can be a significant advantage for businesses looking to foster long-term customer relationships.

On the downside, Paystone may not have the same brand recognition as industry giants like Square or Stripe, which could be a consideration for businesses that prioritize working with a well-established provider. Additionally, while Paystone offers a comprehensive set of features, its platform may be more complex to navigate compared to some of the more streamlined interfaces provided by competitors.

Unique Selling Points: What sets Paystone apart is its commitment to providing an integrated platform that goes beyond simple payment processing. The inclusion of customer loyalty programs, gift card solutions, and marketing automation tools within the same platform offers businesses a unique value proposition. This integration enables companies to handle payments and interact with customers, which boosts growth by improving customer relationships. Paystone’s emphasis on personalization and expandability cements its status as a adaptable option for companies looking to thrive and adjust in a competitive industry.

Integration and Compatibility

Paystone excels in providing seamless integration and compatibility across various software and hardware platforms, making it an adaptable solution for businesses with diverse needs. Whether it’s integrating with existing business systems or ensuring compatibility with a wide range of hardware, Paystone’s approach focuses on flexibility and ease of use.

Software Integration: One of Paystone’s strong points is its compatibility with various business software, including accounting systems, customer relationship management (CRM) tools, and inventory management platforms. This ensures that businesses can streamline their operations by connecting Paystone’s payment processing capabilities with other essential business functions. The ease of integration is a notable advantage, allowing businesses to quickly incorporate Paystone into their existing workflows without significant disruption.

Paystone also offers robust API availability, which is critical for developers looking to customize the integration process. The availability of these APIs allows businesses to tailor the platform to their specific needs, ensuring that all necessary functions are covered. Moreover, Paystone provides developer support to assist with any technical challenges that may arise during the integration process, further simplifying the implementation.

Hardware Compatibility: In terms of hardware, Paystone supports a variety of point-of-sale (POS) systems, which is crucial for businesses that rely on specific devices. The platform is compatible with a wide range of POS hardware, ensuring that businesses can continue to use their preferred equipment without the need for costly upgrades. This compatibility extends to third-party devices and peripherals, making it easier for businesses to integrate their existing hardware setup with Paystone’s solutions.

Ensuring long-term adaptability is crucial for businesses, and Paystone tackles this by providing options to update its services in line with technological progress. Whether it involves incorporating new ways to pay or connecting with the newest gadgets, Paystone’s system is built to grow with the business, guaranteeing its usefulness and importance over time.

Market Presence and Reputation

Paystone has established a significant market presence in North America, particularly within Canada and the United States. As a leading provider of payment processing and customer engagement solutions, Paystone has successfully expanded its reach through strategic acquisitions and partnerships, solidifying its position in the competitive fintech landscape.

Market Share and Reach

Paystone primarily operates within North America, where it serves over 30,000 merchant locations across various industries, including retail, hospitality, healthcare, and automotive. The company’s growth has been driven by key acquisitions, such as the purchase of DataCandy, NXGEN Canada, and POS West, which have expanded its customer base and enhanced its service offerings. These strategic moves have allowed Paystone to broaden its market reach and provide a comprehensive suite of solutions to businesses of all sizes.

In addition to its core market, Paystone has formed key partnerships that further strengthen its position. Collaborations with major brands like Irving Oil, The Source, and Global Pet Foods have bolstered its reputation and provided access to a wide array of industry sectors. These partnerships not only enhance Paystone’s credibility but also allow the company to tailor its solutions to meet the specific needs of various industries.

Reputation and Customer Feedback

Users have a strong positive opinion of Paystone, praising its extensive features and user-friendly interface. Feedback given on the internet shows overall contentment with the service, specifically praising its customer interaction tools and smooth payment processing integration. Merchants value the platform’s capability to integrate various functions into one user-friendly system.

However, some users have noted areas for improvement, particularly in terms of pricing transparency and the complexity of navigating certain features. Despite these concerns, Paystone maintains a strong customer retention rate, indicating a high level of overall satisfaction. The company’s commitment to customer support and ongoing innovation plays a significant role in its ability to retain clients and foster long-term relationships.

Pros and Cons of Paystone

Advantages:

Integrated Platform: Paystone’s key strength lies in its integrated platform, which combines payment processing, customer loyalty programs, and marketing automation tools. This integration allows businesses to manage multiple aspects of their operations from a single interface, streamlining processes and reducing the need for multiple vendors. The platform’s ability to turn everyday transactions into customer engagement opportunities gives it a competitive edge, particularly for businesses focused on enhancing customer loyalty and retention.

Flexibility and Scalability: Paystone is designed to be flexible and scalable, making it suitable for businesses of all sizes. Whether you run a small business or a large enterprise, the platform can be customized to fit your specific needs. This scalability is particularly beneficial for businesses that are growing or have multiple locations, as Paystone can easily adapt to changing requirements.

Customer Support: Another benefit is Paystone’s dedication to providing customer support. Users can anticipate quick and knowledgeable help through multiple support channels like phone, email, and chat. Users can maximize platform features with the help of a thorough knowledge base and tutorials available.

Disadvantages:

Pricing Transparency: One of the main drawbacks noted by users is the lack of transparency in pricing. While Paystone offers competitive pricing, some users have reported that the fee structure can be complex and not as clear upfront. This can make it challenging for businesses to fully understand the costs involved and to compare them accurately with other providers.

Complexity of Features: Although it offers a robust set of features, some users find the platform’s interface to be complex, particularly when navigating more advanced functions. This could present a learning curve for new users or small businesses that may not have the resources to dedicate to mastering the platform.

Limited Brand Recognition: Compared to some of its larger competitors like Square or Stripe, Paystone has less brand recognition. This could be a consideration for businesses that prefer to work with a more widely recognized provider, particularly in industries where reputation and trust are critical.

In conclusion, it provides a strong and adaptable option for companies seeking to combine payment processing with customer engagement resources. Nevertheless, potential customers need to take into account the intricacies of pricing and features, and consider how these aspects align with their individual business requirements.

Conclusion

Paystone provides a complete and adaptable option for companies looking to combine payment processing with customer interaction features. The integrated platform and scalability are its key advantages, but users should also take into account pricing transparency and complexity. In general, Paystone is suggested for businesses that prioritize customer loyalty and operational efficiency.

FAQs

What types of businesses can benefit the most from Paystone’s services?

Paystone’s services are ideal for small to medium-sized businesses, especially in industries like retail, hospitality, and healthcare, where customer engagement and loyalty are key to growth.

Are there any long-term contract commitments with Paystone?

Paystone offers flexible contract terms, including month-to-month options, though longer commitments may be required for certain services, with associated termination fees.

How does Paystone ensure the security of transactions and customer data?

Paystone ensures security through PCI compliance, advanced encryption, and robust fraud detection measures, protecting both transaction data and customer information.