Stax Payment Review

- 05th Aug, 2025

- | By Linda Mae

- | Reviews

Stax (formerly Fattmerchant) is a US-based payment technology company that bills itself as an all-in-one platform for businesses of all sizes. Unlike many traditional payment processors that are percentage-based, Stax is subscription-based. This makes it a disruptor in the payments space, especially for businesses that process high volume and want to save on fees. Lets read more about Stax Payment Review.

The company offers end-to-end solutions for in-person and online payment needs. Their unified platform includes a virtual terminal, mobile processing, invoicing, analytics and integrations with major accounting and ecommerce software. Stax’s value proposition is simplicity and transparency – direct access to wholesale interchange rates with no markup.

Stax is very clear about their goal to empower businesses by giving them control over their payment infrastructure. Instead of just being a processor, the platform wants to be a payment ecosystem for retail, service-based and SaaS businesses.

While Stax is not as widely known as some larger payment giants, it has carved out a niche by addressing pain points like opaque pricing, scattered software tools, and limited insights into payment performance. However, the platform is not without trade-offs. Businesses with low monthly volumes may find the subscription fee less cost-effective. Still, for the right merchant profile, Stax offers a promising alternative to more traditional options.

Table of Contents

ToggleCore Features and Capabilities | Stax Payment Review

Stax’s core strength lies in its well-integrated suite of payment and business tools. The platform is built to serve both in-person and digital payment needs, giving businesses flexibility across multiple touchpoints. One of its key features is the virtual terminal, which allows merchants to accept card-not-present transactions through any web-enabled device. This is especially useful for phone orders, invoices, and remote billing.

The platform also supports mobile payment processing, offering businesses a way to accept payments on the go using a card reader paired with a mobile app. This is complemented by features like invoicing, recurring billing, and subscription management, which cater to businesses with service-based models.

For analytics-driven users, Stax offers a robust reporting dashboard. It provides transaction-level insights, sales tracking, and payment summaries, helping merchants make informed financial decisions. Users can easily search, filter, and export data to integrate with their internal systems.

Another noteworthy feature is third-party integration support. Stax connects with major tools like QuickBooks, Zapier, and ecommerce platforms, allowing smoother accounting and operational workflows.

The system is designed with ease of use in mind, offering a clean UI and centralized access to all features through a single login. While it doesn’t offer the extensive developer-level customization of some platforms, its core capabilities are strong enough to cover most day-to-day payment and business management needs. For businesses looking for a centralized hub that goes beyond payment processing, Stax delivers solid functionality.

Subscription-Based Pricing Model Explained

One of the key differences with Stax is our subscription based pricing model. Unlike traditional payment processing, we don’t charge a percentage on each transaction. Instead we offer direct interchange rates plus a flat monthly subscription fee. This is designed to help businesses keep more of their revenue – especially those processing high monthly volumes.

The idea is simple: pay one flat monthly fee (typically $99/month for small businesses) and get access to wholesale card rates without the markup. This transparent pricing can save you a lot of money compared to traditional processors who charge a percentage on every transaction. But this model isn’t for everyone. For low volume merchants the subscription fee may outweigh the benefits of wholesale rates. A business processing only a few thousand a month may end up paying more with this model than with a per-transaction fee model.

It’s also important to note that certain add-ons and features, such as advanced analytics, API access, or hardware rentals, may incur additional fees depending on the plan tier. Therefore, while the pricing structure is more predictable and potentially more cost-effective for larger businesses, it still requires careful evaluation based on individual usage and growth projections.

In short, Stax’s pricing works best for businesses looking to scale, those that already process large volumes, or companies that value a predictable monthly cost over variable fees.

Hardware and POS Integration Options

Stax provides a solid range of hardware solutions to support both in-store and mobile payment needs. Whether you’re running a physical storefront, a pop-up shop, or a service-based business on the go, the platform offers flexibility in how payments are accepted.

For countertop use, Stax supports a variety of EMV and NFC-enabled terminals from trusted brands like Dejavoo and PAX. These devices support chip cards, contactless payments, and PIN-based debit cards. They are also capable of integrating with the Stax software to ensure that transaction data flows smoothly into the reporting dashboard.

In addition to traditional terminals, the company also offers mobile card readers that pair with smartphones or tablets. These are ideal for businesses that operate in the field or don’t have a fixed checkout location. The mobile app is functional, easy to use, and allows for on-the-spot payments and digital receipts.

For businesses that already use POS systems, Stax offers integration capabilities with third-party POS software. While it may not support every POS on the market, it does cater to several commonly used platforms in retail, healthcare, and hospitality.

One area where Stax is more limited is in offering proprietary POS hardware. Unlike Square or Clover, which offer all-in-one smart terminals, Stax relies more on partnerships with existing device manufacturers. Still, the overall hardware flexibility is adequate, especially for merchants who prefer to bring their own devices or have industry-specific needs.

Online and Ecommerce Payment Solutions

Stax provides a range of tools tailored for online businesses and ecommerce retailers, making it a competitive option for those looking to accept payments beyond a physical store. At the core of its digital offering is the virtual terminal, which lets merchants accept online or phone payments securely through a web browser. This is particularly useful for service providers, freelancers, and any business that invoices clients remotely.

For ecommerce retailers, Stax supports shopping cart integrations and hosted payment pages. These features allow businesses to embed secure checkout options on their websites or redirect customers to a branded payment page without the need for complex coding. Additionally, Stax offers API access for businesses that require custom ecommerce solutions or need to build payment workflows into their web applications. This level of customization appeals to SaaS companies and developers managing more advanced platforms.

Recurring billing and subscription management are also part of the ecommerce toolkit. Merchants can automate customer payments, send branded invoices, and track payment status through the dashboard. One limitation worth noting is that while Stax handles domestic online transactions well, its international capabilities are not as extensive as some global-first platforms. Businesses with a U.S.-centric focus will find the ecommerce features more than sufficient, but global operations should verify regional compatibility first.

Reporting, Analytics, and Business Insights

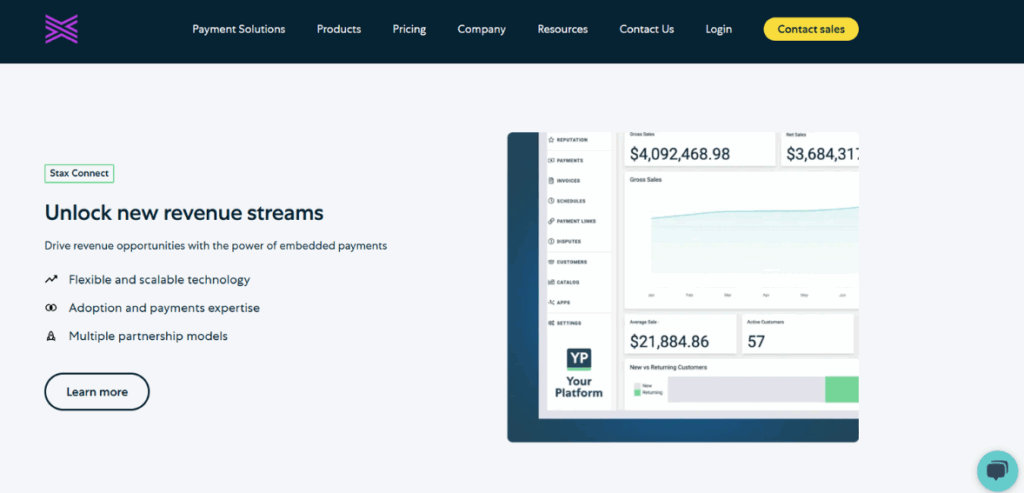

One of the best things about Stax is the analytics and real-time reporting. The platform has a single dashboard where business owners can see sales trends, transaction volume, payment types and customer behaviour.

Through this dashboard you can filter by time periods, compare growth metrics and download detailed reports that make accounting and forecasting a breeze. Whether it’s understanding revenue flow, finding top selling products or tracking payment disputes the tools give you full visibility on your financial performance.

Stax also has batch settlement views and payment status monitoring which reduces reconciliation errors and helps with cash flow management. The ability to export reports into QuickBooks or Excel formats is super useful for businesses that manage their own books or work with accountants.

For businesses that manage subscriptions or recurring payments the analytics tools also help track customer retention and recurring revenue which is super useful for SaaS and membership based models. That said, some of the more advanced analytics capabilities are only available in higher-tier plans. Businesses looking for deeper insights into customer segmentation or predictive analytics may find these tools locked behind additional fees.

Overall, the reporting functionality is robust for most operational needs. It simplifies financial oversight, minimizes guesswork, and enables more confident business planning.

Customer Support and Onboarding Experience

Customer service is often a make-or-break factor for any software provider, and Stax offers a fairly solid support infrastructure. The company provides assistance through phone, email, and live chat, along with a knowledge base filled with guides, FAQs, and video tutorials. The onboarding process is streamlined, with most businesses able to get up and running within a few days. Account managers are available to walk merchants through hardware setup, dashboard navigation, and initial configuration. For tech-savvy users, the setup is intuitive enough to complete independently.

However, customer reviews show a mixed experience when it comes to responsiveness. While many users praise the helpfulness of the support team during onboarding, some note delays or inconsistent follow-up when seeking help with technical issues or disputes. Support hours are generally within standard U.S. business times, which could be limiting for businesses operating late shifts or weekends. Additionally, certain issues; such as API troubleshooting; may be escalated to specialized teams, resulting in longer resolution times.

Stax also provides resources for self-service, which is a plus for users who prefer to troubleshoot independently. But for businesses that need 24/7 or multilingual support, the platform may not fully meet those expectations. In summary, the onboarding experience is user-friendly and professional, while the customer support is adequate but not exceptional. Businesses with complex setups or high dependency on support should weigh this aspect carefully.

Ideal Business Types and Scalability

Stax is designed to work for all businesses but really shines with medium to high volume merchants. The flat fee pricing model is most beneficial when a business processes enough transactions to offset the monthly fee and get the wholesale interchange rates. Retailers with online and offline presence can benefit from the unified payments system. Service based businesses like law firms, healthcare providers and agencies like the invoicing and recurring billing tools.

Stax is also popular with SaaS companies and subscription based services due to the strong recurring payment features and API integrations. Businesses that value data visibility, automation and seamless payment workflows get the most out of the platform. But smaller businesses or those just starting out may not see immediate ROI. If a business processes less than $5,000-$10,000 per month in card payments the fixed monthly fee may outweigh the potential savings.

Scalability is a strength, as the platform grows with the business. Upgrading to higher-tier plans unlocks additional capabilities like advanced analytics, integrations, and support features. Its modular structure also allows businesses to add on services as needed without a complete overhaul. Overall, Stax is a good fit for growing companies that need a professional-grade solution with predictable costs, especially those who prefer to centralize all payment operations under one platform.

Pros and Cons of Using Stax

Like any payment platform, Stax has its advantages and drawbacks depending on your business size and priorities.

Pros include the transparent pricing model, which can lead to significant savings for high-volume merchants. The platform’s comprehensive feature set; virtual terminal, recurring billing, invoicing, analytics; means businesses don’t need to cobble together third-party apps. The UI is clean and user-friendly, and the software integrates with tools like QuickBooks, making bookkeeping easier.

Another strength is the subscription-based structure, which avoids percentage markups and gives businesses clarity on monthly costs. For those who process large amounts, this predictability can be a game-changer. However, cons include the relatively high monthly fee, which might not make sense for smaller businesses. The platform also lacks proprietary POS hardware and relies on third-party terminals, which could be a limitation for those seeking a tightly integrated, plug-and-play hardware solution.

Additionally, some users have cited inconsistent support experiences, particularly outside of onboarding. Businesses that operate internationally may also find its global features somewhat limited. In short, Stax works well for businesses that are growing, processing substantial volume, and want more control over their payment stack. But for startups or low-volume businesses, the cost-benefit balance may not lean in its favor.

Final Verdict: Is Stax Worth It?

Stax offers a strong alternative to traditional payment processors, especially for growing or established businesses seeking pricing transparency and advanced features. Its all-in-one platform provides wholesale rates, in-depth reporting, and integrated tools, making it ideal for industries like retail, healthcare, SaaS, and professional services. The subscription-based model can lead to significant savings for high-volume merchants but may be costly for smaller businesses or those with fluctuating revenue. While it lacks broad hardware options and international capabilities, its streamlined dashboard and control over payment operations make it a compelling choice for businesses frustrated with hidden fees and fragmented payment systems.

FAQs

Q1. Is Stax suitable for small businesses?

Stax is more cost-effective for businesses processing large volumes. Small businesses with low transaction amounts may not benefit from the subscription fee and could be better served by percentage-based processors.

Q2. Can I use my own payment terminal with Stax?

Yes, Stax supports a range of third-party terminals. However, businesses should confirm compatibility and integration support before committing to hardware.

Q3. Does Stax support recurring payments and subscriptions?

Yes, Stax offers strong recurring billing and subscription management features, making it a good fit for SaaS companies, memberships, and service-based billing models.