Switch Commerce Review

- 04th Nov, 2024

- | By Linda Mae

- | Reviews

Switch Commerce, founded in 2003 and based in Irving, Texas, is a payment processing solution that is well-known for its expertise in ATM processing. Operating in multiple areas such as the U.S., U.S. Virgin Islands, Puerto Rico, and some parts of the Asia-Pacific region, the company is designed to cater to the demands of different sectors, specifically those with large transaction amounts and cash requirements. Switch Commerce has established itself as a versatile choice for small businesses and larger organizations in industries such as retail, convenience stores, gas stations, restaurants, and dispensaries, offering robust ATM and cash management solutions. Let’s delve deeper into the Switch Commerce Review.

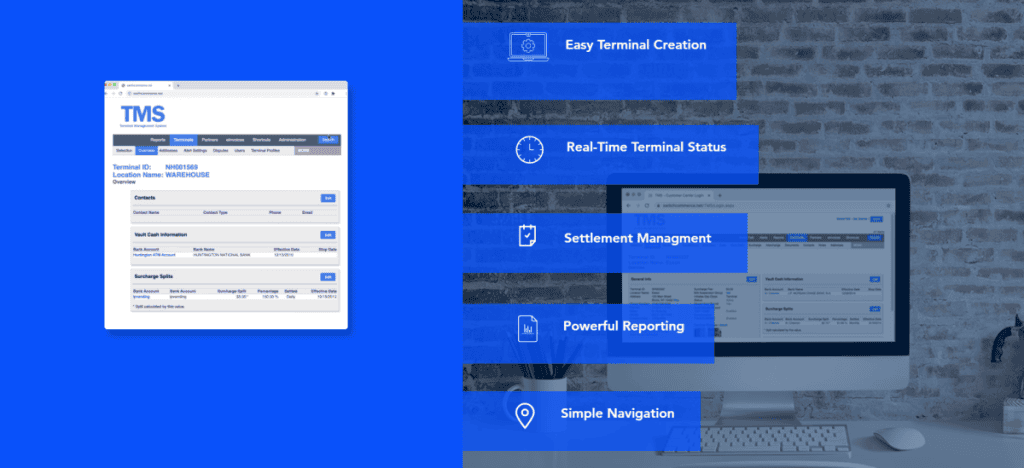

Switch Commerce’s core services include a suite of ATM management features designed to streamline cash handling and improve business efficiencies. The company offers proprietary Terminal Management Systems (TMS), which enable businesses to monitor their ATM networks, manage settlements, and receive real-time alerts on terminal status, a crucial feature for ensuring seamless operations. Additionally, Switch Commerce’s Vault Cash Program allows businesses to keep their working capital in other investments, while the company handles ATM cash stocking. Another notable feature, Dynamic Currency Conversion (DCC), allows businesses in high-tourism areas to earn additional revenue by enabling foreign currency transactions directly at ATMs, appealing to both the tourism sector and international clientele.

The value proposition for businesses lies in Switch Commerce’s strong focus on reliability and customization. With a reported 99.999% system uptime, businesses can rely on uninterrupted access to ATMs and processing services. The company’s solutions cater to diverse needs across industries and provide added revenue opportunities, positioning Switch Commerce as a strong contender for businesses looking for dedicated ATM services rather than broader payment processing. This targeted approach helps distinguish Switch Commerce in a competitive market focused on cash-based and ATM-centric operations.

Company Background

Switch Commerce, founded in 2003, is headquartered in Irving, Texas, and has established itself as a prominent player in ATM processing and cash management solutions. Initially focused on ATM processing, the company quickly expanded its service capabilities to address various needs within the ATM industry, including advanced terminal management, cash vault services, and currency conversion options. This growth has allowed Switch Commerce to carve a niche in ATM and financial services, particularly within the United States, the U.S. Virgin Islands, Puerto Rico, and parts of the Asia-Pacific region.

From the beginning, Switch Commerce has focused on prioritizing customers by creating a transaction processing platform that is reliable and responsive to their needs. One of the key service expansions is the implementation of the Vault Cash Program, which allows businesses to release working capital by having Switch Commerce handle cash for ATM restocking. This action has caused Switch Commerce to be highly favored by businesses wanting to uphold liquidity and still use on-site ATMs. Another significant development is the implementation of DCC feature on ATMs in popular tourist locations, enabling foreign cardholders to conduct transactions in their own currencies, benefiting

Today, Switch Commerce serves a diverse customer base, from retail outlets and convenience stores to gas stations and restaurants, supporting both small and large businesses. By consistently focusing on specialized ATM services and reliable operational support, the company has maintained steady growth and remains a go-to provider for businesses that prioritize cash handling efficiency and innovative ATM solutions. Its robust, globally distributed network and customer-oriented approach have positioned it as a respected name in the industry.

Key Services and Solutions Offered

Switch Commerce offers a robust set of services focused on ATM processing, cash management, and mobile solutions tailored to diverse business needs. Specializing in financial transactions, its services are widely used by retail outlets, convenience stores, gas stations, and high-volume cash businesses, making it a versatile choice in the transaction processing industry.

Payment Processing Solutions: Although primarily an ATM processor, it also facilitates key payment methods such as credit and debit cards. This setup supports traditional transaction types and integrates easily with businesses that process credit cards alongside ATMs. In high-tourist areas, Switch Commerce’s DCC option allows ATMs to accept foreign currencies, a significant advantage for businesses looking to capture international transactions, especially in airports and tourist hotspots.

ATMs and Cash Management: Switch Commerce’s primary service revolves around ATM services, providing TMS to help businesses oversee ATM status, handle cash flow, and troubleshoot from a distance. TMS offers real-time reporting to assist users in staying efficient and settling disputes by accessing transaction histories. Switch Commerce’s Vault Cash Program assists cash-heavy businesses by offering cash-loading and reconciliation services, enabling them to increase available working capital. Automated reversal functionalities also decrease the necessity for manual processing of undispensed transactions, simplifying operations.

Mobile Payment Solutions: The mobile transaction capabilities of Switch Commerce extend to both retail and remote environments, making it suitable for businesses on the go. Its Mobile Terminal Management System (MTMS) enables easy ATM management from mobile devices, alerting businesses to low funds and allowing real-time adjustments to ATM status.

Point of Sale Solutions: Switch Commerce’s POS solutions focus on compatibility and seamless integration, providing businesses with adaptable software that supports various retail operations. These POS systems are designed to integrate smoothly with existing transaction processes, enabling efficient management of sales, cash flow, and customer transactions. This versatility in Switch Commerce’s offerings helps businesses of all sizes and types achieve streamlined operations and optimized financial transactions.

Platform Features and Technology

It offers a feature-rich platform focused on usability, security, and scalability, designed to meet the transaction needs of businesses of various sizes and industries. The dashboard and interface of Switch Commerce emphasize ease of use and accessibility, allowing business operators to navigate intuitively through the platform. The dashboard supports real-time transaction insights, enabling users to monitor activity and access detailed reporting. This setup is particularly useful for businesses requiring clear, immediate data for transaction tracking and decision-making.

Switch Commerce follows strict industry regulations, such as PCI-DSS compliance, to ensure the security and compliance of user data during transactions. The system utilizes high-level security measures like data encryption and multi-factor authentication to prevent fraud and unauthorized entry, lowering the dangers related to confidential financial data. It ensures a secure environment by performing regular audits and updating security protocols, meeting regulatory requirements to uphold vital security standards and maintain customer trust.

Customization and scalability are core strengths of Switch Commerce, allowing the platform to adapt to various business sizes and operational needs. Its flexible architecture supports small and medium-sized enterprises as well as larger operations, providing tailored solutions to accommodate different transaction volumes and security requirements. Integration with various business types, from retail to specialized high-cash industries, is seamless, making Switch Commerce an adaptable solution. This level of customization and scalability enables businesses to adjust their usage of Switch Commerce as they grow, ensuring that their transaction management capabilities evolve alongside their operational needs.

Customer Support and Service Quality

Switch Commerce’s customer support and service quality are designed to provide dependable assistance to businesses, prioritizing accessibility, responsiveness, and dedicated resources. The company offers 24/7 support via phone and email, ensuring round-the-clock access to assistance for transaction processing, ATM management, and technical issues. Level 1 support is available at all times, with Level 2 support offered during business hours for more specialized needs, providing a flexible structure that suits businesses of all sizes and transaction volumes.

Customer experiences with Switch Commerce’s support generally reflect positively on the quality of service, emphasizing knowledgeable representatives and quick responses to issues, particularly for real-time troubleshooting and compliance inquiries. The company’s dedicated team aids clients with operational and technical challenges, often assisting Independent Sales Organizations (ISOs) and other ATM providers in managing their portfolios. To ease onboarding, it provides training resources, familiarizing clients with the platform’s interface, reporting tools, and compliance requirements, which helps businesses leverage the system efficiently from the start.

Switch Commerce provides dedicated account managers to offer personalized support to businesses in need of extra guidance. These managers serve as the primary contacts for clients, helping them with integrating services, setting up technical configurations, and understanding compliance requirements. This approach is advantageous for clients with intricate operational needs or regulatory demands, offering personalized advice and strategic assistance.

By combining 24/7 access, personalized account management, and extensive onboarding, Switch Commerce effectively supports businesses in maintaining smooth transaction processes and compliant operations, making it a reliable choice for companies that prioritize consistent and accessible service.

Pricing Structure and Contracts

Switch Commerce offers a flexible pricing structure, though detailed pricing information, including transaction fees, setup costs, and other charges, is not openly disclosed on its website. While the company’s previous rates for services like iPayHere were publicly listed, recent updates have removed most of the pricing details, making it challenging to gauge costs precisely without a direct consultation. However, available reports suggest a competitive transaction rate structure, including a swipe rate around 2.99% and fixed monthly fees, which aligns with industry norms for similar services.

Regarding contract terms, Switch Commerce does not publish specific details about contract lengths or early termination fees, which can sometimes be important for prospective clients to understand fully before committing. While minimum contract lengths and potential cancellation policies remain unconfirmed, it’s common in the industry for providers like Switch Commerce to operate with multi-year agreements that may carry penalties if terminated early. Therefore, businesses considering Switch Commerce are encouraged to review any contract terms thoroughly to avoid unforeseen commitments.

Switch Commerce is highly regarded for its value for money, as it provides specialized ATM management services along with currency conversion and automated transaction reversals, which can lead to increased operational efficiency and revenue possibilities. Customers have noted that despite the need for extra research due to the absence of clear public pricing, the specialized services for ATMs, along with excellent customer service, often result in a positive ROI when compared to regular ATM service providers. In general, despite some unclear pricing details, Switch Commerce’s wide range of solutions provides significant value for cash-heavy businesses looking for specialized ATM solutions.

Pros and Cons of Using Switch Commerce

Switch Commerce has several notable pros and cons, making it suitable for specific business needs while leaving room for improvement in other areas.

Pros: Switch Commerce offers unique strengths, particularly in its specialized services for ATM management. With a high uptime rate (99.999%) and advanced TMS, businesses can monitor, control, and troubleshoot their ATMs remotely, which is invaluable for companies with multiple locations or high cash flow needs. Additionally, Switch Commerce’s Vault Cash Program enables businesses to free up working capital by managing ATM cash stocking, a major advantage for companies that want to focus their resources elsewhere. The platform’s DCC feature also supports international transactions at ATMs, catering to high-tourism areas and allowing businesses to earn from currency exchange fees.

Cons: Switch Commerce’s pricing transparency is limited, as specific transaction fees, setup costs, and contract terms are not readily available. This lack of openness can make it challenging for businesses to fully assess costs and make informed decisions. Additionally, while Switch Commerce is known for its ATM-centric offerings, it does not currently support broader payment processing or POS services, which may limit its appeal for businesses seeking an all-in-one solution. The absence of publicized contract terms, like cancellation fees or minimum contract lengths, can also be a drawback, as it introduces potential uncertainty for customers regarding long-term commitments and exit options.

Areas for Potential Improvement: Increased clarity in pricing and contract terms would greatly improve Switch Commerce’s attractiveness by enabling businesses to assess its cost-effectiveness more effectively. Adding comprehensive payment processing services, such as credit card or POS systems, could enhance Switch Commerce’s versatility for businesses requiring various financial transaction solutions beyond ATM management. Focusing on these areas may enhance Switch Commerce’s positioning as a preferred solution for various business types and transaction requirements.

Customer Reviews and Reputation

Switch Commerce generally receives favorable reviews from users, reflecting positive experiences across its ATM processing and customer service. Users often praise the platform for its reliability and ease of use, highlighting how its tools for ATM management streamline operations. Many customers report satisfaction with Switch Commerce’s user-friendly interface and responsiveness, especially for businesses managing multiple ATMs. Additionally, several reviews commend the company’s competitive rates and the efficient support from its customer service team, noting that assistance is both prompt and effective.

In terms of industry reputation, Switch Commerce is recognized for its specialized ATM processing services and is generally well-regarded among ISOs and small to medium businesses. While it does not yet hold any prominent awards, the platform’s 99.999% uptime and reliability are consistently noted as industry strengths. These features, along with programs like DCC and Vault Cash, have positioned Switch Commerce as a reliable solution, particularly for businesses in high-cash flow sectors such as retail and hospitality.

Indicators of customer satisfaction show a combination of positive and average feedback. Although Switch Commerce does not have accreditation from the Better Business Bureau, it has few complaints, indicating a mostly happy customer group. Switch Commerce has a high rating of approximately 4 out of 5 on Trustburn, with customers often mentioning dependable service and supportive customer assistance. Overall, the platform has become a reliable ATM processor for various business needs due to its strong performance in customer service, reliability, and functionality.

Competitor Comparison

Switch Commerce’s main competitors include large payment processors and ATM service providers like NCR, Fiserv, Heartland Payment Systems, and Global Payments. Each of these companies offers a range of financial technology solutions, though their focus areas and service scopes vary. NCR and Fiserv, for example, are well-established in both digital banking and retail technology, providing integrated solutions that go beyond ATM management to include broader transaction processing, POS services, and financial data management tools. These companies are industry giants with extensive networks and advanced technology for end-to-end payment and banking needs.

Switch Commerce is notable for its expertise in managing ATMs and providing solutions for handling cash. Switch Commerce differentiates itself from bigger competitors by specializing in ATM processing, cash-loading services, and high-cash-flow tools, attracting businesses that value ATM performance and cash flow optimization. Businesses can efficiently handle cash reserves and make money from foreign currency exchanges with unique services like the Vault Cash Program and Dynamic Currency Conversion for ATMs. Switch Commerce is especially attractive for businesses in high ATM usage or tourist-centric locations due to its customized services, which can generate additional income through DCC.

Additionally, Switch Commerce’s 99.999% uptime and advanced TMS provide clients with reliability and detailed control over their ATMs, a benefit that isn’t typically emphasized by larger multi-service providers. This level of uptime and focus on specialized ATM management can be a decisive factor for companies that rely heavily on ATM availability and require a streamlined, dedicated solution without the added complexity of broad-scale financial products.

Conclusion

Switch Commerce is the perfect solution for businesses that have a large requirement for ATMs, especially in industries with high amounts of cash flow such as retail, convenience stores, and areas frequented by tourists. Best suited for small to medium-sized businesses prioritizing specialized cash solutions over broad payment processing, with a focus on ATM management, cash handling, and reliable uptime.

FAQs

What types of businesses benefit most from Switch Commerce?

Switch Commerce is particularly advantageous for high-cash-flow businesses like retail stores, convenience stores, and gas stations, as well as tourist-heavy locations where DCC can enhance revenue through foreign exchange fees.

How secure is Switch Commerce’s payment processing?

Switch Commerce prioritizes security with PCI-DSS compliance and advanced data encryption protocols, ensuring high standards of transaction security and fraud prevention, making it a secure option for sensitive payment data handling.

What is the cancellation policy for Switch Commerce’s contracts?

Specifics on contract length and cancellation fees are typically disclosed during the consultation, and businesses are encouraged to confirm these terms directly with Switch Commerce representatives to avoid unexpected commitments.