Apple Pay Review

- 12th Dec, 2024

- | By Linda Mae

- | Reviews

Since its launch in 2014, Apple Pay has transformed the manner in which individuals perform transactions. Developed by Apple Inc., this mobile payment and digital wallet service offers a convenient, secure, and seamless way to make payments. In contrast to conventional payment methods, Apple Pay utilizes cutting-edge technologies to provide a contactless payment experience that meets contemporary needs for speed and safety. Through its ongoing development, Apple Pay has emerged as a fundamental element of digital payments, establishing standards for rivals such as Google Pay and Samsung Pay. Let’s delve deeper into the Apple Pay Review.

Apple Pay’s appeal lies in its ability to simplify the payment process while maintaining robust security features. It caters to both consumers and merchants, ensuring a frictionless transaction experience.

Features of Apple Pay | Apple Pay Review

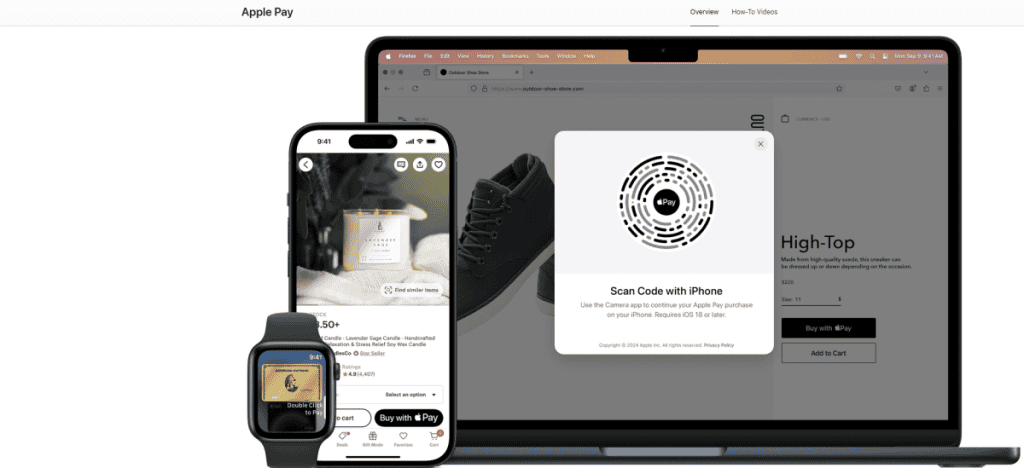

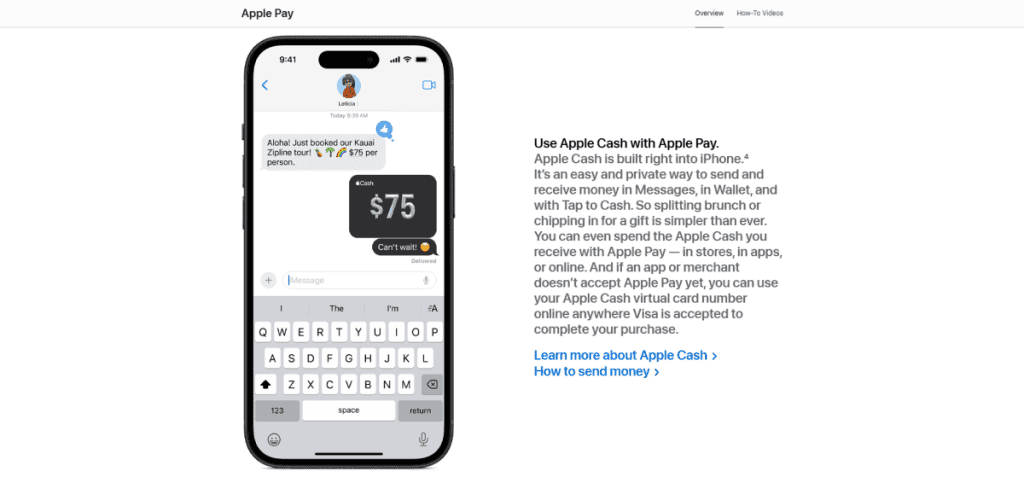

Apple Pay is a versatile platform that supports various transaction types, ensuring adaptability in different scenarios. Users can pay in-store, online, and even within mobile apps. One of the service’s most prominent features is its integration with the Apple Wallet, where users can store and manage their payment cards, boarding passes, and loyalty cards.

Apple Pay’s core features include:

Contactless Payments: Apple Pay uses NFC technology, allowing users to complete payments by just tapping their device on a compatible terminal.

Cross-Device Compatibility: The service is compatible across the Apple ecosystem, including iPhones, iPads, Apple Watches, and Macs. This integration ensures a unified user experience.

App and Online Purchases: It supports payments within apps and websites using Safari. This feature eliminates the need to enter card details manually, enhancing speed and reducing errors.

Transit Support: In various global cities, it is compatible with public transport systems, enabling users to effortlessly cover transit costs.

Integration with Loyalty Programs: It allows users to store and use loyalty and reward cards, making it a one-stop solution for payments and customer rewards.

Express Transit Mode: In areas where it’s supported, It offers a quicker, tap-and-go transit experience without the need for Face ID, Touch ID, or a passcode.

The convenience offered by these features is one of the key reasons for Apple Pay’s widespread adoption, with over a billion Apple devices supporting the service globally.

Setting Up Apple Pay

Setting up Apple Pay is straightforward, ensuring accessibility for all users. Here is a breakdown of the process:

Adding Cards: Users start by launching the Wallet app on their Apple device. They have the option to either scan their credit or debit card or input the information manually. The arrangement is user-friendly and crafted to reduce effort.

Verification: After entering the card information, the issuing bank or card provider verifies the details. This step may involve receiving a verification code via SMS, email, or phone call. For certain banks, additional security questions may be required.

Customization: After the card is confirmed, users can designate a default card for transactions and modify settings specific to their region. They can additionally activate notifications for transaction alerts to monitor spending instantly.

Adding Passes and Tickets: Beyond payment cards, users can also add event tickets, boarding passes, and other forms of digital passes to the Wallet app.

The setup process reflects Apple’s commitment to user-centric design. Once configured, Apple Pay is ready to be used across supported platforms and merchants, ensuring a smooth start for new users.

Security and Privacy Measures

Apple Pay has built its reputation on robust security measures, prioritizing user safety without compromising convenience. The service employs several advanced technologies to ensure secure transactions:

Tokenization: Instead of transmitting actual card details, Apple Pay uses a unique Device Account Number (DAN) for each card. This number is encrypted and securely stored on the device’s Secure Element chip, making it inaccessible to malware or unauthorized applications.

Biometric Authentication: Transactions are approved through Face ID, Touch ID, or a passcode. This removes the threat of unauthorized access even if the device is misplaced or taken.

No Data Storage: It does not store transaction data on its servers or share card information with merchants. This approach ensures that users’ financial details remain private and inaccessible to third parties.

Dynamic Security Code: Each transaction generates a unique, dynamic security code. This ensures that even if intercepted, the data cannot be reused.

Lost or Stolen Devices: If a device is misplaced or taken, users can remotely turn off Apple Pay via the Find My feature, stopping any unauthorized use. They can also delete cards from their account immediately.

Privacy by Design: Apple does not track or log user transactions, ensuring a high level of privacy.

These measures collectively make Apple Pay one of the most secure payment methods available, addressing concerns about fraud and data breaches.

User Experience

Apple Pay’s user experience is a testament to Apple’s design philosophy, focusing on simplicity, speed, and reliability. Users consistently praise the service for its ease of use in everyday scenarios:

Speed: Transactions with Apple Pay are almost instantaneous, making it ideal for busy environments like retail stores, public transport systems, and drive-thru restaurants.

Intuitive Interface: The Wallet app is neatly structured, enabling users to easily reach their cards, tickets, and passes. The interface is aesthetically pleasing and crafted for simple navigation.

Reliability: It is known for its consistent performance, with minimal reports of technical glitches. It operates efficiently even during high-demand periods like holiday shopping seasons.

Accessibility: Attributes like VoiceOver compatibility guarantee that users with disabilities can access Apple Pay.

Users also appreciate the convenience of not carrying physical wallets, as it consolidates payment methods and essential documents in a single app. This digital-first approach aligns with modern consumer habits and preferences.

Compatibility and Integration

Apple Pay’s compatibility extends across a wide range of devices and financial institutions. This broad integration is one of the service’s strongest selling points:

Supported Devices: It works on iPhones (iPhone 6 and later), iPads, Apple Watches, and Macs. This ensures that users can access the service regardless of their preferred device.

Bank and Card Support: Nearly all significant banks and card issuers globally back Apple Pay, such as Visa, Mastercard, American Express, along with local banks. This guarantees broad availability for consumers.

Merchant Acceptance: Many retail stores, restaurants, and e-commerce platforms accept Apple Pay, making it a versatile payment method. From small businesses to multinational chains, merchant acceptance has grown significantly since Apple Pay’s launch.

Loyalty and Transit Cards: It additionally accommodates the integration of loyalty cards and transit passes, improving its capabilities. For instance, users can directly include Starbucks or Dunkin’ rewards cards in the Wallet app for convenient access.

Smartwatch Integration: The ability to pay with an Apple Watch adds convenience for users who may not have their phone readily available.

Cross-Border Usability: It facilitates global transactions, enabling users to pay in various currencies while on their travels.

Despite some regional limitations, Apple Pay’s widespread compatibility ensures that users can rely on the service in various scenarios, both locally and internationally.

Advantages of Using Apple Pay

It offers numerous benefits, making it a preferred choice for many users:

Enhanced Security: Through tokenization, biometric verification, and changing security codes, Apple Pay greatly lowers the chance of fraud.

Convenience: The ability to pay with a tap or click simplifies transactions, especially for frequent shoppers or travelers. Users no longer need to search for physical cards or cash.

Eco-Friendly: It promotes eco-friendly practices by minimizing the reliance on physical cards, cash, and receipts. Numerous retailers provide e-receipts that are linked to the Wallet app.

Global Usability: Apple Pay’s international support makes it a reliable option for travelers, reducing the need for currency exchanges or additional cards.

Seamless Integration: Apple Pay’s ability to integrate with loyalty programs, transit systems, and app payments enhances its utility.

Contactless Advantage: As hygiene awareness has grown, Apple Pay’s contactless technology has become more essential in reducing physical contact points.

These advantages highlight Apple Pay’s value proposition, appealing to a diverse audience from tech-savvy millennials to business professionals seeking convenience and security.

Challenges and Limitations

Despite its strengths, it has certain limitations that users should consider:

Regional Availability: Although it is broadly accepted, certain countries and areas face restricted support because of regulatory or technical obstacles. Local banking collaborations also affect accessibility.

Device Dependency: Only Apple devices support the service, excluding users of other ecosystems. This creates a barrier for Android or non-Apple users.

Battery and Connectivity Issues: It necessitates a powered device and, in certain instances, an internet connection, which might not always be accessible. For example, individuals might encounter difficulties in emergencies or while traveling in isolated regions.

Merchant Fees: Some merchants face transaction fees when accepting Apple Pay, which can deter adoption. Additionally, smaller businesses may lack the infrastructure to support NFC payments.

Limited Offline Functionality: While it can keep some data locally, some features might not work without an internet connection.

Addressing these challenges could further enhance Apple Pay’s reach and usability, making it more inclusive and versatile for a global audience.

Impact on the Payment Industry

It has had a profound impact on the payment industry, driving the adoption of contactless payments and influencing consumer behavior:

Popularizing Contactless Payments: The introduction of Apple Pay motivated other tech firms to create analogous solutions, fostering a competitive environment. It also had a major influence on making contactless payments more common, particularly during the COVID-19 outbreak.

Merchant Adaptation: Retailers have increasingly invested in NFC-compatible terminals to cater to Apple Pay users, accelerating the adoption of digital payment infrastructure worldwide.

Consumer Trust: Apple Pay’s robust security measures have set new standards, pushing competitors to enhance their offerings and adopt similar security protocols.

Shaping Cashless Economies: It has motivated governments and financial organizations to advocate for digital payment methods, aiding the expansion of cashless economies worldwide.

By fostering innovation and competition, It has played a pivotal role in shaping the future of digital payments, encouraging a move toward cashless economies.

Future of Apple Pay

As technology evolves, It is poised to introduce new features and expand its capabilities:

Cryptocurrency Integration: As digital currencies become increasingly popular, it might add support for cryptocurrency transactions, providing users with a wider range of payment choices.

Enhanced AI and ML Features: Future updates may include predictive spending analytics and smarter payment suggestions, personalizing the user experience.

Expanded Regional Support: Apple Pay’s continued expansion into untapped markets will solidify its global presence and accessibility.

Deeper Ecosystem Integration: With the increasing interconnection of Apple devices and services, Apple Pay may take on a pivotal role within the company’s ecosystem, facilitating developments in augmented reality shopping and voice-activated payments.

Advanced Loyalty Integrations: Future updates may focus on offering tailored promotions and incentives through integrated loyalty programs.

These developments underscore Apple Pay’s potential to remain a leader in the digital payment space, continuously evolving to meet consumer and merchant needs.

Frequently Asked Questions

How secure is Apple Pay compared to traditional credit/debit cards?

Apple Pay uses advanced security features like tokenization and biometric authentication, making it significantly more secure than traditional cards, which rely on static card details.

Can I use Apple Pay internationally? Are there any limitations?

Yes, Apple Pay can be used internationally wherever NFC-compatible terminals and supported banks are available. However, some countries may have limited merchant acceptance.

What should I do if my Apple device with Apple Pay is lost or stolen?

If your device is lost or stolen, you can use the Find My app to remotely disable Apple Pay. Additionally, your card information remains secure as it is not stored on the device or shared with merchants.