Credit card processing is a vital component of modern commerce, enabling businesses to accept payments from customers using credit and debit cards. Integral to this ecosystem are ISOs and MSPs or Independent Sales Organizations (ISOs) and Merchant Service Providers (MSPs). These entities play crucial roles in facilitating payment processing services between merchants and the card networks. This article explores the functions of ISOs and MSPs, differentiates between them, and discusses their significance in the credit card processing landscape.

What Are ISOs and MSPs?

Independent Sales Organizations (ISOs)

An Independent Sales Organization (ISO) is a business entity that partners with acquiring banks to sell credit card processing services to merchants. ISOs act as intermediaries, providing sales, marketing, and support services to merchants who wish to accept card payments. They do not directly process transactions but instead work with acquiring banks and payment processors to offer merchant accounts and payment solutions.

Merchant Service Providers (MSPs)

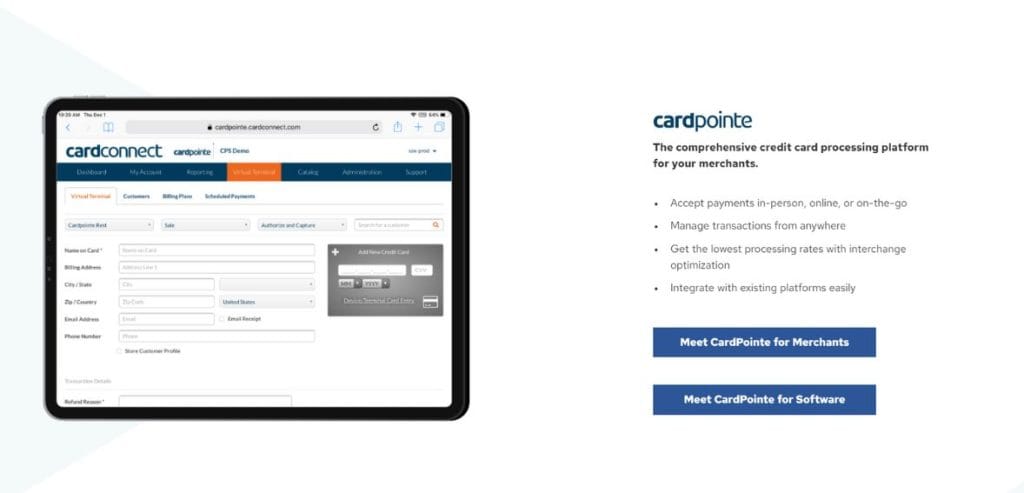

Merchant Service Providers (MSPs), while similar in function to ISOs, typically offer a broader range of services. MSPs may provide comprehensive payment solutions, including point-of-sale (POS) systems, payment gateways, and integrated software solutions. MSPs may also handle underwriting, risk management, and customer support, making them a one-stop-shop for merchants looking to streamline their payment processing needs.

Understanding the Difference Between ISOs and MSPs

While ISOs and MSPs are often used interchangeably, they have distinct roles and functions in the payment processing industry. Here’s a breakdown of their differences:

Scope of Services

– ISOs: Focus primarily on sales and marketing of payment processing services. Their main role is to recruit merchants and facilitate the setup of merchant accounts with acquiring banks.

– MSPs: Offer a more comprehensive suite of services, including hardware, software, and payment gateway solutions. MSPs may also provide technical support, merchant training, and consulting services.

Relationship with Acquiring Banks

– ISOs: Serve as intermediaries between merchants and acquiring banks. They do not hold merchant accounts but instead work under the sponsorship of an acquiring bank.

– MSPs: Often have direct relationships with acquiring banks and may handle underwriting and risk management processes themselves. Some MSPs may also act as ISOs, providing a range of services beyond just payment processing.

Regulatory and Compliance Roles

– ISOs: Must comply with regulatory requirements set by the Payment Card Industry Data Security Standard (PCI DSS) and other relevant regulations. They are responsible for ensuring that their merchants meet these standards.

– MSPs: Besides compliance with PCI DSS, MSPs may have additional responsibilities related to fraud prevention, risk assessment, and merchant support. Their broader service scope often requires them to maintain a higher standard of compliance and security.

How Do ISOs and MSPs Work?

The Process of Onboarding Merchants

- Merchant Identification: ISOs and MSPs identify potential merchants who require payment processing services. They assess the merchant’s needs and propose suitable solutions.

2. Application and Underwriting: The merchant completes an application, which is then submitted to the acquiring bank. The ISO or MSP may assist with underwriting and evaluating the merchant’s creditworthiness and risk profile.

3. Account Setup: Upon approval, the ISO or MSP facilitates the setup of the merchant account, integrating the necessary payment processing equipment and software.

4. Training and Support: ISOs and MSPs provide training to merchants on using POS systems, payment gateways, and other tools. They also offer ongoing support to resolve any issues that may arise.

Transaction Processing Workflow

- Payment Initiation: The customer initiates a transaction at the merchant’s POS terminal or online payment gateway.

2. Authorization Request: The transaction details are sent to the payment processor, which forwards the request to the card network (e.g., Visa, MasterCard).

3. Approval/Rejection: The card network routes the request to the issuing bank for authorization. The issuing bank approves or declines the transaction based on the customer’s credit status and available funds.

4. Settlement: Once approved, the transaction details are sent back through the network to the merchant’s acquiring bank. The funds are then settled into the merchant’s account, typically within 24-48 hours.

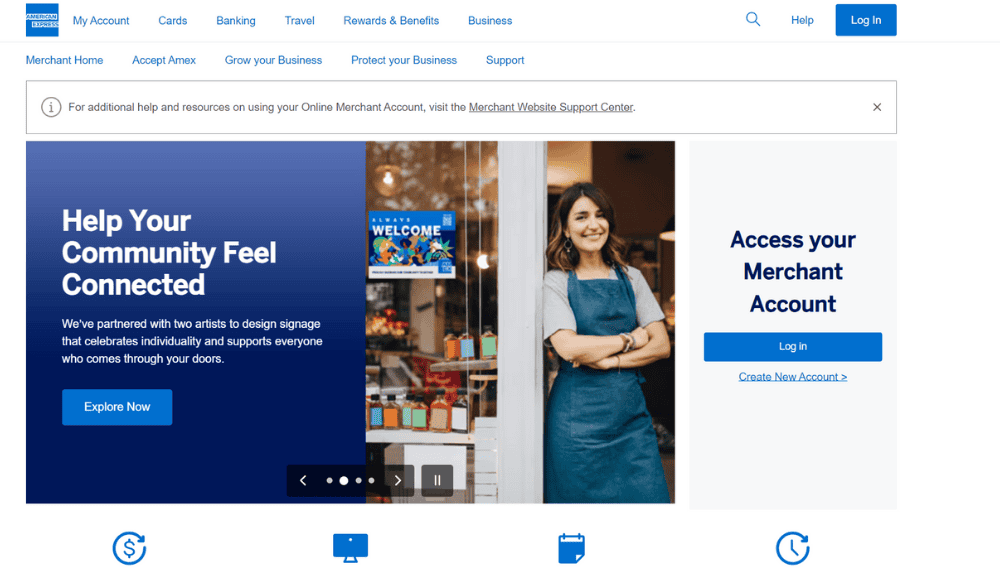

How to Determine if a Business is Registered as an ISO/MSP

Checking Registration Details

- Contact the Acquiring Bank: The acquiring bank can confirm whether a business is registered as an ISO or MSP and provide details about their authorization and services.

2. Industry Databases: Several industry databases and regulatory bodies maintain records of registered ISOs and MSPs. These databases can be accessed online to verify the registration status of a business.

3. Professional Associations: Organizations like the Electronic Transactions Association (ETA) and the National Association of Payment Professionals (NAPP) provide directories of registered ISOs and MSPs.

Reviewing Documentation

– Licenses and Certifications: Check for valid business licenses, state registrations, and certifications from relevant payment industry bodies.

– Service Agreements: Review the service agreements and contracts offered by the ISO or MSP to ensure they outline the scope of services, fees, and compliance requirements.

What is the Role of an ISO/MSP?

Merchant Acquisition and Support

– Sales and Marketing: ISOs and MSPs actively market their services to potential merchants, leveraging various channels such as online marketing, trade shows, and direct sales teams.

– Merchant Education: They educate merchants on the benefits of different payment solutions, helping them choose the most suitable services for their business needs.

Payment Processing Solutions

– Service Provision: ISOs and MSPs provide the necessary technology and infrastructure for payment processing, including POS systems, payment gateways, and mobile payment solutions.

– Integration and Customization: They assist merchants in integrating payment processing systems with their existing business operations, offering customization options to fit specific requirements.

Compliance and Risk Management

– Ensuring Compliance: ISOs and MSPs ensure that their merchants comply with PCI DSS standards and other regulatory requirements, providing necessary tools and training.

– Fraud Prevention: They implement fraud detection and prevention measures, helping merchants safeguard against chargebacks, fraud, and security breaches.

Customer Support and Service

– Technical Support: ISOs and MSPs offer ongoing technical support to resolve issues related to payment processing systems, ensuring minimal disruption to the merchant’s operations.

– Training and Consultation: They provide training sessions and consultation services to help merchants maximize the benefits of their payment processing systems.

Should You Work with an ISO/MSP?

Benefits of Partnering with an ISO/MSP

– Expertise and Experience: ISOs and MSPs bring industry knowledge and experience, offering valuable insights and solutions tailored to your business needs.

– Comprehensive Solutions: They provide a range of services and products, simplifying the setup and management of payment processing systems.

– Ongoing Support: With dedicated support teams, ISOs and MSPs ensure that merchants receive timely assistance and solutions to any challenges they encounter.

Considerations Before Choosing an ISO/MSP

– Reputation and Reviews: Research the reputation of potential ISOs and MSPs by reading reviews, checking industry ratings, and seeking recommendations from other businesses.

– Service Offerings: Evaluate the range of services offered, ensuring they align with your business requirements. Consider factors such as transaction fees, support services, and technology integration capabilities.

– Compliance and Security: Confirm that the ISO or MSP adheres to the latest security standards and regulatory requirements. Ensure they have robust fraud prevention and data protection measures in place.

Making the Decision

Choosing whether to work with an ISO or MSP depends on your business needs, the complexity of your payment processing requirements, and your preference for service and support. For businesses seeking a straightforward relationship with minimal service integration, an ISO may be sufficient. However, if you require a comprehensive suite of payment solutions and ongoing support, partnering with an MSP could be more beneficial.

Conclusion

ISOs and MSPs play indispensable roles in the credit card processing ecosystem, bridging the gap between merchants and financial institutions. Understanding their functions, differences, and the value they bring can help businesses make informed decisions about their payment processing needs. Whether you choose to work with an ISO or an MSP, the key is to ensure that your chosen partner aligns with your business goals, provides reliable services, and supports your growth in the competitive market.