Capital One Merchant Services Review

- 30th Sep, 2024

- | By Linda Mae

- | Reviews

Capital One Merchant Services was introduced as an expansion of Capital One Bank, targeting the provision of payment processing solutions for businesses, specifically small and medium-sized enterprises (SMEs). Capital One can provide a wide range of services, such as credit and debit card processing, mobile payment options, and e-commerce solutions, by teaming up with Worldpay, a reputable merchant services provider. Let’s delve deeper into the Capital One Merchant Services Review.

The main aim of Capital One Merchant Services is to make payment processing easier for businesses through providing trustworthy and secure solutions. This enables merchants to concentrate on their main activities without having to be concerned about managing transactions. Capital One’s goal is to serve a diverse range of businesses, including physical stores and online e-commerce sites, in order to help them efficiently handle payments across various platforms.

In today’s business environment, merchant services play a crucial role in driving sales and customer satisfaction. With the shift towards digital payments and the increasing need for security and convenience, businesses require robust solutions that can handle different types of payments, from contactless and mobile to traditional swipe methods. By providing these services, Capital One supports businesses in keeping up with evolving payment trends, reducing fraud risks, and maintaining smooth cash flow. This is particularly important as customer expectations rise, and businesses look to offer seamless payment experiences to stay competitive.

Overview of Products and Services | Capital One Merchant Services Review

Capital One Merchant Services offers a broad range of products designed to meet the needs of modern businesses. By partnering with Worldpay, the company delivers efficient payment processing capabilities that handle a wide array of payment methods, allowing businesses to serve their customers with flexibility and convenience. Whether for small businesses or larger enterprises, Capital One’s services are aimed at enhancing the transaction experience and simplifying payment management.

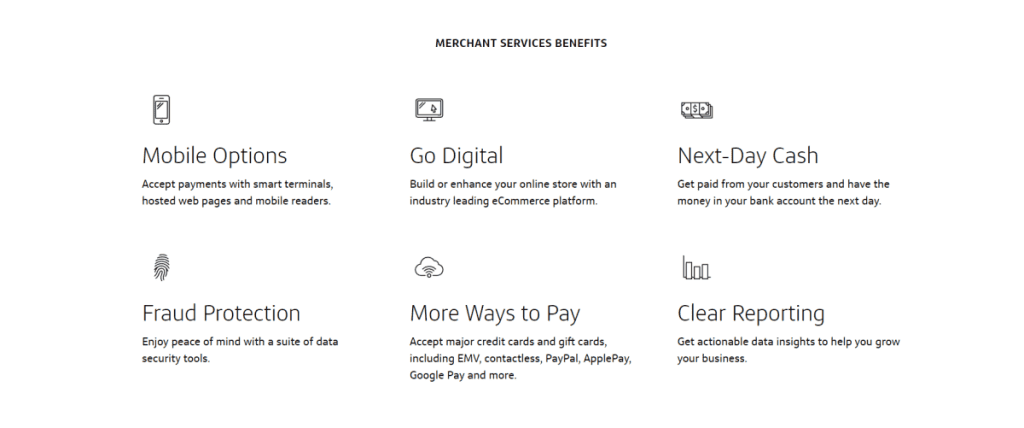

One of the main features is its payment processing functions, which encompass assistance for credit cards, debit cards, and digital wallets like Apple Pay, Google Pay, and PayPal. This range of options allows businesses to receive payments from almost any customer, regardless of whether they are buying online, in person, or on their mobile devices. The collaboration with Worldpay offers companies trustworthy and speedy payment processing, which includes next-day funding that is crucial for cash flow management.

Capital One provides a range of online and in-store payment options, as well as handling payment transactions. Some examples are mobile card readers, POS systems, and e-commerce payment gateways. These solutions are created to be simple to set up and blend with current systems, allowing businesses to quickly and efficiently begin accepting payments.

Capital One Merchant Services also provides value-added services such as invoicing and recurring payments, which are particularly useful for businesses that offer subscription-based services or need to manage multiple transactions over time. With these additional services, businesses can automate billing, reduce administrative tasks, and improve the customer experience by offering more payment options and flexibility.

Payment Processing Solutions

Capital One Merchant Services provides comprehensive payment processing solutions that cater to businesses across various industries. By leveraging Worldpay’s technology, Capital One enables businesses to accept payments seamlessly across multiple channels, whether online, through mobile devices, or in-store. This flexibility ensures that businesses can provide their customers with a consistent, smooth payment experience, regardless of how or where they choose to make purchases.

Capital One provides various forms of support across multiple channels, such as eCommerce, mobile payments, and retail transactions. Businesses can incorporate Capital One’s solutions into their online stores for eCommerce by utilizing payment gateways that securely handle transactions and customer data. Businesses can accept payments on the go with the help of mobile card readers and apps that support mobile payments. Retail stores profit from in-person payment systems that allow various payment options like credit and debit cards, contactless payments, and digital wallets.

In terms of integration, Capital One Merchant Services is designed to work seamlessly with both existing POS systems and custom-built options. This compatibility makes it easier for businesses to upgrade their payment systems without overhauling their entire setup. Additionally, virtual terminals are available for businesses that need to process payments remotely, such as for phone orders or manual transactions.

Security is a top priority for Capital One Merchant Services. To protect sensitive customer data, their payment processing solutions include advanced features like tokenization, which replaces card details with unique tokens, and robust fraud detection tools that monitor transactions in real-time. Capital One is also fully compliant with PCI DSS (Payment Card Industry Data Security Standard), ensuring that businesses meet the highest standards of security to protect both themselves and their customers from data breaches and fraud.

Fees and Pricing Structure

Capital One Merchant Services, operating through its partner Worldpay, offers a pricing structure that can vary depending on the specific needs of the business. While there are no fixed pricing details openly available, certain fees and rates are consistent across most accounts. Businesses are typically charged setup fees, monthly service fees, transaction fees, and additional costs depending on their chosen service options.

The transaction fees for credit and debit card processing with Capital One are typically tiered. For example, swiped transactions are charged around 2.90% plus a $0.30 fee, while keyed-in (card-not-present) transactions may cost around 3.30% plus $0.30. Businesses also face monthly fees that can include PCI compliance fees, which range between $15 to $25 per month, and an annual reporting fee, which can be approximately $69.

Capital One’s fees generally match industry standards when compared to competitors, but they may not be the most competitively priced. Certain other providers offer wholesale rates or pricing based on membership, potentially decreasing transaction expenses for businesses handling more transactions. Nonetheless, Capital One provides flexibility in contractual discussions, especially for smaller to medium-sized enterprises, potentially leading to better terms for individual merchants depending on their transaction volumes and type of business.

Capital One Merchant Services provides personalized pricing plans depending on the size and volume of transactions for businesses with high transaction volumes. This allows companies to discuss prices and charges that more closely match their requirements for payment processing. These plans are advantageous for businesses with a high volume of transactions, as they typically offer more competitive pricing.

However, businesses should be aware of potential hidden costs, such as early termination fees, which can range from $95 to $495. Additionally, equipment leasing costs and automatic contract renewals may incur extra expenses if not carefully managed. Transparency in pricing is an area where businesses are encouraged to review their contracts thoroughly to avoid unexpected costs.

Integration and Compatibility

Capital One Merchant Services offers robust integration and compatibility options, designed to seamlessly fit into various business systems. Whether businesses operate through physical retail locations, eCommerce platforms, or mobile setups, Capital One’s services ensure smooth integration with a wide range of software and hardware solutions. This flexibility is crucial for businesses that need their payment processing system to function across multiple channels without disruption.

For retail environments, Capital One’s services integrate with a variety of Point of Sale (POS) systems. This allows businesses to accept payments through card readers, smart terminals, and mobile devices. The hardware is compatible with most major POS systems, ensuring that businesses don’t need to overhaul their existing infrastructure to utilize Capital One’s merchant services.

Businesses that utilize eCommerce platforms such as Shopify or WooCommerce can smoothly incorporate Capital One’s payment gateway into their online stores on the software end. This integration allows customers to have a seamless and safe checkout experience, whether they are shopping on a desktop or a mobile device. Capital One offers an API for developers to create personalized applications that meet specific business requirements. This API support is especially beneficial for companies needing custom payment solutions or extra features in their current systems.

Accounting software integration is another key feature of Capital One Merchant Services. The platform supports compatibility with popular accounting tools such as QuickBooks, making it easy for businesses to track transactions, manage payments, and reconcile accounts. This streamlining of payment data into financial management tools helps businesses save time and reduce manual errors.

One of the standout features is the simplicity of use and setup. Capital One makes sure that the integration process is easy, providing specialized assistance to help businesses start promptly. Capital One’s merchant services are a convenient option for various industries, offering flexible integration for both small businesses and larger enterprises.

Customer Support and Service

Capital One Merchant Services offers a variety of customer support channels designed to meet the diverse needs of its clients. Businesses can reach out to Capital One for assistance via phone, email, or live chat, ensuring they have multiple ways to connect with support when needed. While the availability of 24/7 support may depend on specific plans or services, the company strives to provide responsive and efficient service to help resolve issues promptly.

Capital One’s customer support is typically seen as robust, but the level of service can differ depending on the specific situation. The support team is well-informed about the services they provide, such as payment processing, integration assistance, and security concerns. Businesses often get support from account managers who are specialized in assisting them, especially when they are onboarding. Nevertheless, a few clients have observed that response times may be quicker at times of high demand.

Capital One also provides a range of online resources for its merchant services clients. These resources include comprehensive guides, FAQs, and troubleshooting tips, all designed to help businesses resolve common issues independently. The availability of these self-help tools is particularly valuable for merchants who prefer to handle minor issues on their own or want to learn more about optimizing their payment solutions.

Another critical aspect of Capital One’s customer support is its merchant training and onboarding process. When businesses sign up for Capital One Merchant Services, they receive step-by-step guidance to ensure that the setup and integration process runs smoothly. The company offers tutorials, webinars, and personalized training sessions to help merchants get the most out of their payment processing systems. This emphasis on thorough onboarding and continued support ensures that businesses can maximize the effectiveness of the services they receive from Capital One.

Security and Compliance Features

Capital One Merchant Services places a strong emphasis on security and compliance to protect both businesses and their customers. With an increasing number of digital transactions and potential fraud risks, maintaining a high level of security is critical for any payment processor. Capital One ensures that its merchant services comply with the highest industry standards while offering advanced tools to safeguard sensitive financial data.

Capital One Merchant Services adheres to the Payment Card Industry Data Security Standard (PCI DSS), which is a crucial security protocol in place. All businesses processing credit card transactions are required to comply with PCI DSS regulations to guarantee merchants adhere to data protection best practices. This involves keeping cardholder data secure, encrypting sensitive information, and consistently monitoring for weaknesses.

Capital One provides advanced fraud detection tools that monitor transactions in real-time to identify and address suspicious activity before it becomes a security threat. These tools aid businesses in reducing chargebacks and minimizing losses from fraud. The system utilizes machine learning algorithms to identify abnormal transaction patterns, giving businesses more authority and supervision over their payment processing.

Encryption and tokenization are additional layers of security provided by Capital One. Encryption ensures that all sensitive data, such as credit card information, is scrambled during transmission, making it inaccessible to unauthorized parties. Tokenization further enhances security by replacing actual card details with unique, non-sensitive tokens, which can only be decoded by authorized systems. This minimizes the risk of data exposure, even in the event of a breach.

For businesses that require more extensive security measures, Capital One offers risk management services. These services provide businesses with insights into their transaction risks and help them implement strategies to mitigate potential threats. By combining compliance, encryption, and advanced fraud detection, Capital One Merchant Services ensures that businesses can operate securely in today’s digital payment environment.

Pros and Cons

Strengths of Capital One Merchant Services:

Ease of Integration: One of the biggest advantages of Capital One Merchant Services is its seamless integration with various platforms. It supports multiple channels, including in-store, eCommerce, and mobile payments, making it flexible for businesses of all sizes. The compatibility with popular POS systems and accounting software also simplifies the setup and payment management processes.

Security Features: Capital One prioritizes security. By adhering to PCI DSS compliance, utilizing tokenization, and employing encryption, businesses can have confidence in the security of their transactions. The advanced tools for detecting fraud improve security and lessen the chance of chargebacks and fraud, which is a major worry for lots of merchants.

Multi-Channel Support: Capital One offers a variety of payment processing options, from online and mobile transactions to traditional card payments in physical stores. This multi-channel support allows businesses to cater to different customer preferences and streamline their payment operations across all platforms.

Weaknesses or Areas for Improvement:

Complex Fee Structure: One major drawback is the complexity of Capital One’s fee structure. Businesses must navigate through various setup fees, monthly service charges, and transaction fees. Additionally, there are other costs, such as PCI compliance fees and equipment leasing charges, which can make it hard to understand the full cost upfront.

Customer Support: Some companies have experienced delays in receiving responses from Capital One’s customer support channels like phone, email, and live chat, especially during busy times. Improving customer service responsiveness and availability may enhance the overall user experience.

Who Would Benefit Most:

Capital One Merchant Services is best suited for small to medium-sized businesses that require flexible payment processing solutions and robust security. Its multi-channel support makes it ideal for businesses operating both online and in-store, while its security features make it appealing for businesses handling high volumes of transactions. However, businesses looking for simple pricing structures or those needing more responsive customer support may need to carefully consider these factors.

Comparison with Competitors

When comparing Capital One Merchant Services to other major providers like Stripe, Square, and PayPal, there are both similarities and differences that businesses should consider. Each of these companies offers competitive payment processing solutions, but they cater to different types of businesses and needs.

Stripe is recognized for its platform that is friendly to developers, providing a wide range of APIs for personalized integrations, making it a favored option for technology-centric companies and online platforms. The pricing is clear, without any monthly charges and a consistent transaction fee, which is attractive for eCommerce companies seeking flexibility in constructing payment systems.

Square is known for offering user-friendly hardware for face-to-face transactions, like card readers and POS systems. Small businesses and startups prefer it because of its simple and transparent pricing, without any setup fees or monthly charges. Square offers more than just payment processing by including extra features such as inventory management and customer engagement tools for businesses.

PayPal offers the benefit of global recognition and trust, which can increase conversion rates for online retailers. It provides payment solutions for both online and in-person transactions, with the advantage of PayPal’s buyer protection, which can boost consumer confidence. However, PayPal’s fees are often higher than some of its competitors, especially for international transactions.

Capital One’s Unique Selling Points: Capital One Merchant Services, in partnership with Worldpay, focuses heavily on security and multi-channel support. Its ability to integrate with various POS systems and accounting platforms provides flexibility for businesses. Additionally, Capital One offers robust fraud detection tools and PCI DSS compliance, making it particularly suitable for businesses that handle large transaction volumes and need advanced security.

Where Capital One Stands in the Market: Although Capital One Merchant Services is not as well-known as Stripe or Square in the payment processing industry, its collaboration with Worldpay allows it to effectively compete, especially in regards to security and potential for business growth. Nevertheless, small businesses looking for simplicity may not be attracted to its intricate fee system and unclear pricing. For companies that value security and multi-channel support more than user-friendly features and clear pricing, this is the ideal choice.

Conclusion

Capital One Merchant Services offers strong security features, support across multiple channels, and smooth integration, making it a reliable choice for businesses focusing on security and growth. Nevertheless, the intricate fee system might prove difficult for smaller companies. Capital One’s products are well-suited for ensuring secure and flexible payment processing, especially for those dealing with high transaction volumes.

FAQs:

What types of businesses benefit most from Capital One Merchant Services?

Capital One Merchant Services is best suited for small to medium-sized businesses, especially those requiring multi-channel support for in-store, online, and mobile payments. It’s ideal for businesses that prioritize security and scalability.

Are there any hidden fees with Capital One Merchant Services?

While the pricing structure is transparent, businesses should be aware of additional costs such as setup fees, PCI compliance fees, and potential early termination fees.

How secure are payments processed through Capital One Merchant Services?

Payments are highly secure, featuring PCI DSS compliance, tokenization, encryption, and advanced fraud detection tools to safeguard sensitive customer information.